I. PURPOSE

Married couples use Qualified Terminable Interest Property Trusts or QTIP Trusts to postpone estate taxes and provide for the survivor after one spouse passes while protecting assets for other beneficiaries after the second spouse passes.

With a QTIP Trust, the married grantor who is the first spouse to die provides for the surviving spouse. The surviving spouse receives income from the QTIP Trust for the rest of the spouse’s life, without having to pay taxes when the first spouse passes.

The QTIP Trust also empowers the grantor to control where the property in the trust goes when the surviving spouse passes. Thus the grantor spouse can prevent the survivor from disinheriting the grantor’s beneficiaries. QTIP Trusts work well in blended families where the spouses have different beneficiaries – usually children that they did not have together. QTIPs also work well for a grantor who is concerned about the surviving spouse remarrying.

QTIPs can powerfully protect assets from the creditors and possible predators of the surviving spouse, who might try to take those assets.

How does a QTIP Trust avoid taxes at the death of the first spouse? All transfers into the QTIP Trust qualify for the Unlimited Marital Deduction. Because it qualifies for this deduction, the QTIP Trust is a type of “Marital Trust.” The Unlimited Marital Deduction allows spouses who are U.S. citizens to transfer any amount of assets to each other – either as lifetime gifts or at death – without estate or gift tax. In other words, this deduction from estate and gift tax in transfers between spouses is “unlimited”; it can be for any amount. Assets in the QTIP will be included in the surviving spouse’s estate and may be subject to estate tax at the surviving spouse’s death.

II. REQUIREMENTS

To qualify for this special tax treatment, the IRS provides several requirements for a QTIP Trust.

First, the surviving spouse must be entitled to all income for life, to be distributed at least once a year. Second, no person other than the surviving spouse may have an interest in the principal of the trust during the spouse’s lifetime. The QTIP may provide the trustee with discretion to distribute principal to the surviving spouse. Third, no person may have a power to appoint any part of the property to any person other than the surviving spouse during the spouse’s lifetime. Fourth, the trustee must make an election on the estate tax return to qualify certain property as QTIP property.

III. HOW DOES A QTIP TRUST WORK? TAX CONSEQUENCES

How does a QTIP Trust work?

During the surviving spouse’s life, income distributed to the surviving spouse is taxed on the surviving spouse’s tax return. When the surviving spouse passes, property in the QTIP Trust is included in the surviving spouse’s estate – with important estate tax and capital gains tax consequences.

Inclusion in the surviving spouse’s estate causes a basis adjustment at the surviving spouse’s death. The new basis is generally the fair market value of the property on or near the date of death. When the property has increased in value, this new basis is a step-up in basis that can result in significant capital gains tax savings.

Although estate tax may be due on the QTIP assets when the second spouse passes, it will be paid from the QTIP Trust itself. That way, the surviving spouse’s heirs will not have to pay the estate tax from the surviving spouse’s property.

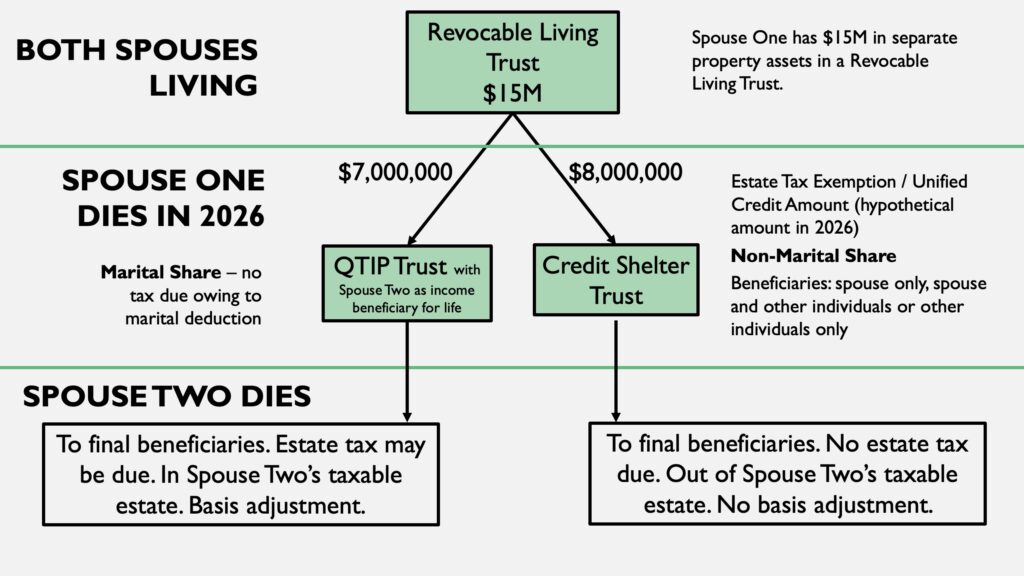

Here’s a typical example of a QTIP Trust in flowchart form.

Spouse One has $15 million in separate property assets. While they are both alive, the spouses form a revocable living trust with QTIP provisions. In community property states like California and Texas, the revocable living trust might be a joint trust. In other states, including Missouri, it is more likely to be a separate property trust. Either way, this diagram tracks only the separate property or property belonging to Spouse One.

When Spouse One dies in 2026, $8 million of Spouse One’s assets funds the Credit Shelter or B Trust, on the hypothetical supposition that the estate tax exemption will be about $8 million at that time. The trustee elects to transfer to the QTIP Trust certain assets valued at $7 million but expected to appreciate or grow in value. Spouse Two does not have to pay any estate or gift taxes at the death of Spouse One.

When Spouse Two dies, the final beneficiaries named by Spouse One receive the property in the QTIP Trust, although it is included in Spouse Two’s taxable estate. The QTIP may owe estate taxes when Spouse Two dies, depending in part on Spouse Two’s remaining exemption amount. However, the QTIP assets will also receive a basis adjustment, which will probably be a step-up in basis that may reduce or eliminate capital gains tax.

IV. QDOT FOR NON-CITIZEN SPOUSES

Qualified Domestic Trusts or QDOTs are similar to QTIPS but are designed to benefit the noncitizen surviving spouse of a U.S. citizen.

The QDOT address fact that the IRS does not extend the Unlimited Martial Deduction to surviving spouse who are not U.S. citizens. The QDOT postpones estate taxes when assets pass from the estate of the first spouse to die to the QDOT for the noncitizen spouse, so the surviving spouse does not get hit with a tax bill at the death of the first spouse. Transfer taxes are imposed either on principal distributions from the QDOT or at the death of the noncitizen spouse, when the assets go to the grantor’s final named beneficiaries.

A QDOT must meets several requirements to qualify for estate tax deferral. At least one trustee must be a US citizen. The US trustee must have power to withhold estate tax on distributions of principal. The QDOT must be established before the estate tax return is due. As with a QTIP, income distributions are required and are taxable to the recipient spouse as income.