I. NAMES

The Credit Shelter Trusts is an estate planning tool for married couples. This type of trust may go by many names, including: Unified Credit Shelter Bypass Trust; Credit Shelter Bypass Trust; Credit Shelter Trust; Bypass Trust; B Trust; or Non-Marital Trust. If your revocable living trust split in two when your spouse passed, the Credit Shelter Trust might be called the “B” trust in the A-B Split. Attorneys sometimes call the Credit Shelter Trust the ‘Buried Spouse’s Trust.’ For brevity, I’ll favor the term “B Trust” in this post.

II. PURPOSE

What is the purpose of a B Trust?

Married couples generally use the B Trust to maximize the estate tax exemption of the first spouse to die. The estate tax exemption is the same as the gift tax exemption. Also called the ”unified tax credit,” this is the amount that one person can gift during life or at death without federal gift or estate taxes. In 2023, the exemption is $12.92 million. If a spouse passes in 2023, up to $12.92 million of assets could fund the B Trust. Any growth in the value of those assets will be “sheltered” from estate tax. This can result in huge tax savings for property that appreciates between the death of the first and of the second spouse. When the surviving spouse passes, assets in the B Trust will not be subject to estate taxes. The B Trust can be funded only with the deceased spouse’s separate property and, in community property states, the deceased spouse’s half of community property.

In addition to tax savings, the B Trust provides the Grantor with control over assets in the trust. The B Trust can provide for the surviving spouse, although that’s not required. The B Trust also enables the Grantor to be sure that other beneficiaries receive assets. B Trusts work well for mixed marriage situations, in which one spouse wishes to ensure that his chosen beneficiaries are not disinherited by the surviving spouse.

B Trusts also can protect assets from the surviving spouse’s creditors, possible remarriages, and potential financial elder abuse.

III. LIFE CYCLE OF A CREDIT SHELTER TRUST

To see how a B Trust works, let’s explore the three phases of its life cycle.

In Phase One, the grantor spouses are both living. The B Trust typically starts life as a provision in the estate plan of a married person. A wealthy couple planning carefully to reduce estate taxes may change the ownership of some property from one spouse to the other, depending on which spouse has more separate property assets, which is more likely to die first, and other factors.

Phase Two begins when the first spouse dies. The B Trust will be funded with that spouse’s separate property and half of community property up to the amount of the deceased spouse’s unused remaining estate and gift tax exclusion. Because these amounts fall under the exemption or exclusion, no estate tax will be due. At this point, the B trust becomes irrevocable. Assets not transferred to the B Trust typically go to the surviving spouse in a Marital Trust. Assets in the Marital Trust are also not subject to tax at this time because of the “Unlimited Marital Deduction,” under which spouses who are US citizens may gift any amount to each other in life or at death without federal gift or estate taxes. The surviving spouse may be a lifetime beneficiary of the B Trust but does not have to be.

In Phase Three, after the surviving spouse dies, the assets in the B Trust pass to the final beneficiaries estate and gift tax free.

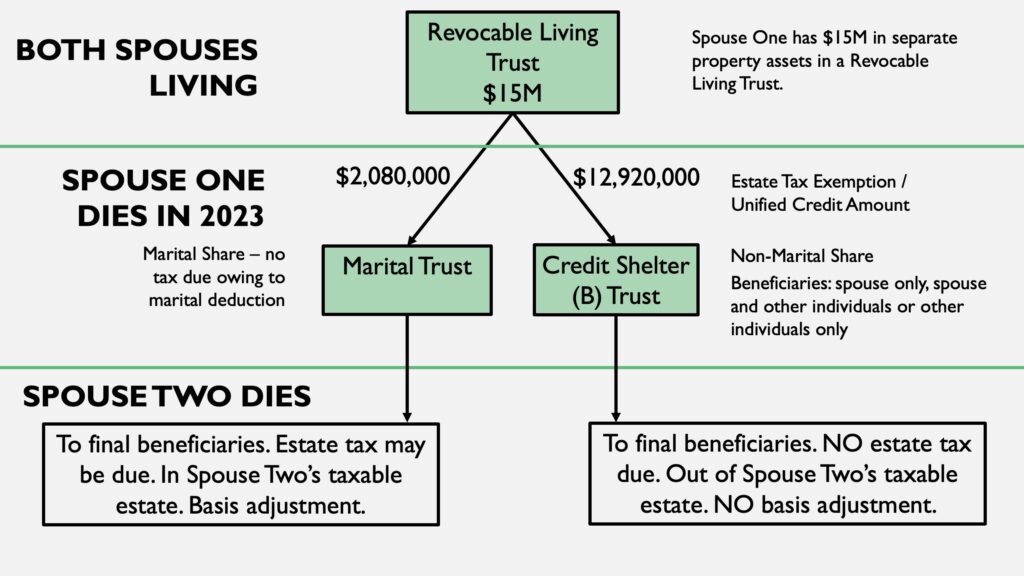

Here’s a typical example of the B Trust life cycle in flowchart form.

In this example, Spouse One owns $15 million in separate property assets. While they are both alive, the spouses form a revocable living trust with B Trust provisions. When Spouse One dies in 2023, $12.92 million of Spouse One’s separate property assets funds the Credit Shelter or B Trust, and the rest goes to a Marital Trust. With this arrangement, Spouse Two does not owe any estate or gift taxes. When Spouse Two dies, the final beneficiaries of the B Trust receive its assets estate-tax free. The Marital Trust may owe taxes when Spouse Two dies, depending in part on Spouse Two’s remaining exemption amount.

IV. CREDIT SHELTER TRUST DISTRIBUTIONS

The married grantor who establishes a B Trust decides how the assets in the B Trust will be distributed when that grantor’s gone. Let’s consider a few common distributions schemes.

First, the B Trust may be arranged so all income from the trust is payable to the surviving spouse, and the spouse may receive distributions of principal in the trustee’s discretion. Distributions of principal typically are not desirable because distributed assets will lose some benefits of the B Trust. Sometimes the B Trust includes remarriage protections, which cut off distributions to the surviving spouse if that spouse remarries without a prenuptial agreement protecting the B Trust assets. After the surviving spouse dies, assets in the B Trust often go to the original couple’s children, either outright or in trust, estate tax free. The B Trust can allow the surviving spouse a limited power of appointment to decide who from among a certain set of beneficiaries receives the remaining assets in the B Trust.

Alternatively, the B Trust may name other beneficiaries along with the surviving spouse during the surviving spouse’s lifetime.

But the surviving spouse does not have to be a beneficiary of the B Trust at all. For example, omitting the surviving spouse as a beneficiary may be suitable for mixed marriages where one spouse is significantly younger than the other.

V. NO BASIS ADJUSTMENT

Perhaps the greatest disadvantage of the B Trust is the lack of a basis adjustment when the second spouse dies.

Many properties get a basis adjustment at death. The new basis is generally the fair market value of the property at death. When the property has increased in value, the new basis is a step-up that can result in huge capital gains tax savings for beneficiaries.

In the typical B Trust scenario, upon the death of the surviving spouse, the assets in the Marital Trust get a basis adjustment, but the assets in the B Trust do not. If beneficiaries of a B Trust wish to sell highly appreciated property, they’ll be faced with a large capital gains tax.

VI. OUTDATED APPROACHES

B Trusts were more common in the past, when the estate tax exemption amount was much lower. If you haven’t updated your trust in a decade or two, you may have some outdated B Trust arrangements that will not accomplish your estate planning goals today.

For example, an older trust may provide that, when the first spouse dies, the maximum amount that can pass to that spouse’s children without estate tax being due will go to a B Trust for them, and the rest will go to a Marital Trust for the surviving spouse. In 2001, when the estate tax exemption was $675,000, that provision would leave a maximum of $675,000 to the children and the rest to the surviving spouse. In 2023, that same provision would leave up to $12.92 million to the children and the rest to the spouse, if there were anything left. Many older B Trust plans have similar unintended consequences given the major change in the exemption amount.

The introduction of portability has also rendered many B Trust plans outdated. Portability allows a surviving spouse to use a deceased spouse’s unused estate tax exclusion amount. Before portability become effective around 2011, many older estate plans included B Trust provisions. These can be a pain today for surviving spouses who do not have taxable estates.

VII. UPDATED MORE FLEXIBLE APPROACHES

Updated B Trust plans for spouses tend to be much more flexible.

A Disclaimer Trust leaves all the deceased spouse’s property outright to the surviving spouse, and gives the survivor the option to disclaim some or all property. Disclaimed property funds the B Trust, to maximize the deceased spouse’s estate tax exemption or to provide the survivor with asset protection. Property not disclaimed goes to the survivor outright or in a Marital Trust. No tax is due on this property when the first spouse dies because of the unlimited Marital Deduction. Disclaimer Trusts provide flexible planning needed given uncertainty about federal and state law exclusion amounts and the future size of a couple’s estate. The key advantage to this type of plan is the ability to assess the estate at the death of the first to die. The decision can be made then to create a B Trust if the estate has grown significantly, if the estate tax exemption has decreased, or where asset protection is desired. The disclaimer must be done within 9 months of the deceased spouse’s date of death. This can be difficult if the surviving spouse is too distraught or not financially savvy enough to disclaim before the deadline.

A Clayton Election also provides flexibility to address the uncertain future of estate tax law. A Clayton Election gives an independent trustee discretion to fund some of the deceased spouse’s property in a B Trust and some in a Marital Trust. Again, property going to the Marital Trust is not subject to tax at the first spouse’s death because of the unlimited Marital Deduction. The trustee can take up to 15 months from the date of death to decide on how or whether to fund the B Trust. This provides time to consider the assets in the estate, the needs of the beneficiaries, and current law before making the election. By shifting the decision to an independent trustee, the Clayton Election removes concerns that the surviving spouse might not disclaim before the deadline.

HELP IS HERE

If you have an older estate plan with B Trust provisions, contact Daniel today and mention this post for a no-charge review of your trust. Click here to upload a copy of your trust through our intake form.